Year-End Report 2023

23 Feb 2024

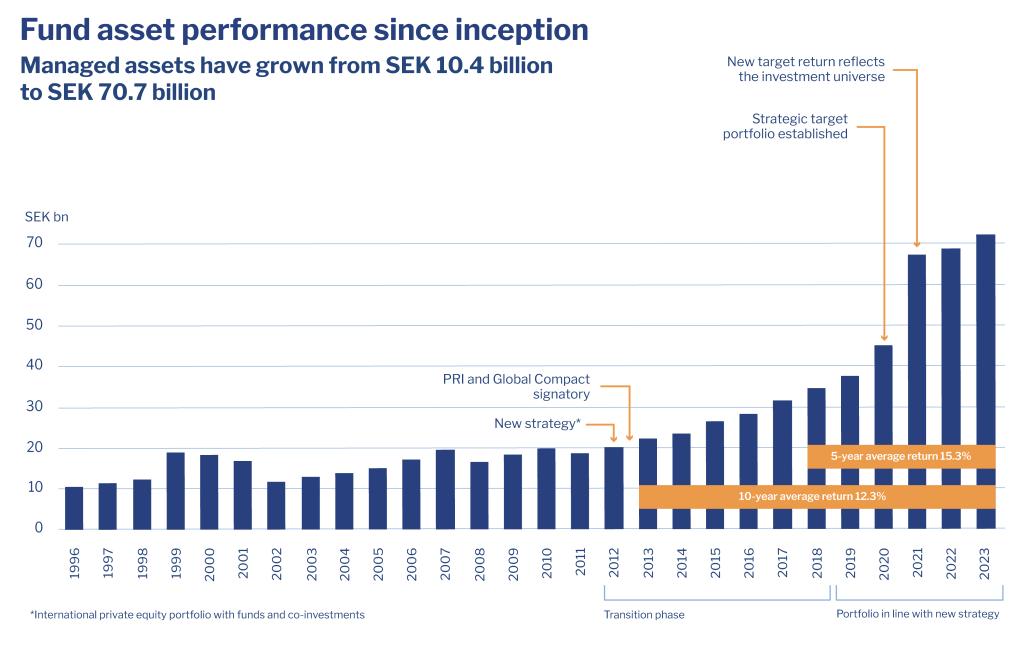

In a year such as 2023, which was interspersed with various challenges, AP6 is reporting positive net earnings of SEK 2.1 billion. Managed assets increased and amount to SEK 70.7 billion. AP6’s five-year return is 15.3 percent, exceeding the target of 11.4 percent. AP6 has generated positive net earnings every year for the past decade.

“The private equity market has slowed down. During the year we invested nearly SEK 1 billion in co-investments and around SEK 4.5 billion in fund commitments. That is conservative from our perspective and demonstrates the consolidation that we are working on and that we expect to create a good basis for an even stronger portfolio structure in the years ahead,” says Katarina Staaf, Managing Director of the Sixth Swedish National Pension Fund (AP6).

In 2023 the market was characterised by a low rate of investment. Fewer transactions were made than in a normal year, impacting the private equity market through fewer distributions, fewer new investments and thus longer fundraising cycles, in contrast to the abnormally short funding cycles that have occurred in recent years. The statutory requirement of currency hedging, which is not appropriate for its purpose, caused AP6 to be very reticent about making new co-investments in 2023 since the liquidity had to be utilised for currency hedges. AP6 is a so-called closed-end fund, where the legislator is aware that it is not possible to extract liquidity on an ongoing basis in the same way as from other AP funds. Requiring extensive currency hedging has a major impact on liquidity in times of volatile exchange rates.

Net earnings for 2023 amounted to SEK 2.1 billion (1.3), representing a return of 3.0 percent (1.9). Internal asset management costs amounted to SEK 104 million (104). The five-year average return was 15.3 percent, which exceeds the 2023 target of 11.4 percent.

Private equity is a long-term asset class and therefore less significance should be attached to individual years. Capital employed for the Venture segment shows an average five-year return of 21.6 percent. The corresponding five-year figure for Buyout is 20.5 percent (of which co-investments are 22.2 percent) and for Secondary 16.6 percent. The total portfolio employed shows an average five-year return of 20.4 percent. Capital employed amounted to SEK 67.7 billion, of which SEK 25.7 billion represents co-investments.

At the end of October 2023 an investigator was instructed to review the operations of the AP funds with a view to modernising and streamlining management of the Swedish national pension funds.

“It is obvious that modernisation is needed, and the currency hedging requirement for our investment portfolio is a clear example of that. Whatever the solution chosen, we anticipate that AP6’s sound expertise, structural capital and successful strategy within private equity will be taken into consideration. From initial capital of SEK 10.4 billion we have generated a return of more than SEK 60 billion and through our successful strategy and investment philosophy have contributed a positive absolute return each year for the past decade,” says Katarina Staaf, Managing Director of AP6.

As a closed-end fund, AP6 has neither inflows nor outflows. To manage the difference in liquidity management a liquidity buffer is required to meet the investment commitments, which may vary over time.

The long-term nature of the fund is illustrated by the fact that an individual fund commitment spans more than 10–15 years and an individual co-investment 3–8 years. An important aspect of the strategy is the combination of high-quality fund commitments and co-investments, with sustainability fully integrated throughout the investment process and owner phase.

The Annual Report for 2023 is available in Swedish at www.ap6.se

An English translation of the Annual Report for 2023 is scheduled to be made available during April at www.ap6.se/en/

For more information:

Ulf Lindqvist, Head of Communications at AP6: +46 708 74 10 48 ulf.lindqvist@ap6.se

Sixth Swedish National Pension Fund (AP6)

Long-term and active investor tasked with investing in unlisted assets (private equity). An important aspect of the strategy is the combination of high-quality fund commitments and co-investments, with sustainability fully integrated throughout the investment process and owner phase. Since its inception AP6 has contributed SEK 60.3 billion to the Swedish public’s pension assets. Since 1996 AP6’s fund assets have grown from SEK 10.4 billion to SEK 70.7 billion at the end of 2023.