Year-End Report 2022

27 February 2023

In 2022 the portfolio demonstrated good resilience despite challenging capital markets. AP6 delivered positive net earnings for the year of SEK 1.3 billion and a return of 1.9 percent, despite a strong negative effect from statutory currency hedges. The investment portfolio delivered a return of 15 percent excluding currency hedges.

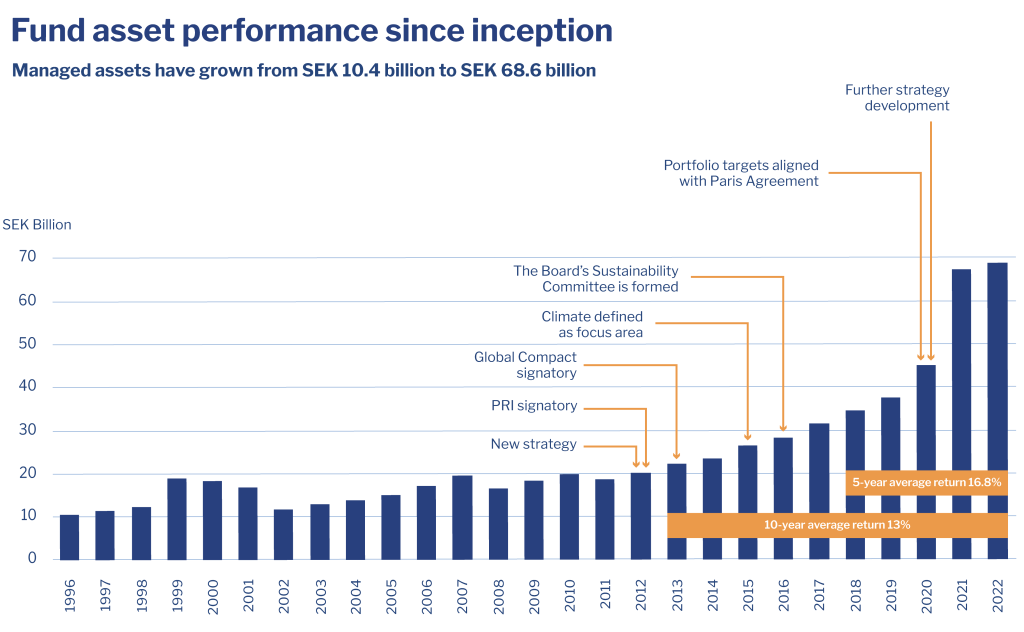

The five-year average return, including a negative contribution from liquidity management, was 16.8 percent, which exceeds the 2022 target of 15.9 percent (Burgiss 5-year). Currency hedges account for a large reduction in earnings, having a negative effect of SEK 5.9 billion. The five-year average return on capital employed was 24.1 percent (or 20.6 percent net after currency hedges).

“In 2022, which was a challenging year, AP6’s portfolio strategy proved to be resilient, with a 15 percent return within the investment portfolio, excluding currency hedging and liquidity. The fund volume stabilised at SEK 68.6 billion, which is the strong level achieved in 2021,” says Katarina Staaf, Managing Director of the Sixth Swedish National Pension Fund (AP6).

Net earnings for 2022 amounted to SEK 1.3 billion (22.2), representing a return of 1.9 percent (49.1). Internal asset management costs amounted to SEK 104 million (98).

“Our portfolio strategy was put to the test in reality during this turbulent year. The portfolio is composed to generate a high, risk-adjusted, long-term return for the benefit of the Swedish pension system. In private equity the risk is not measured through volatility in daily pricing but by the assets’ cash flow profiles. By combining fund and co-investments within buyout with a smaller allocation of higher risk assets in venture, as well as a stable return from secondaries, we have an overall portfolio that provides a high return with a good risk balance,” says Staaf.

The investment portfolio, excluding currency hedges, generated positive returns, with secondaries at 25.9 percent, buyout at 16.3 percent and venture at 5.2 percent, despite a very challenging year. The combined buyout portfolio, which makes up the majority of the total portfolio, contributed SEK 7 billion, secondaries SEK 0.5 billion and venture SEK 0.3 billion, for an aggregate net contribution of SEK 7.8 billion, a large portion of which constitutes distributed realised returns.

As AP6 is a closed-end fund it has neither inflows nor outflows. To manage the difference in liquidity management a liquidity buffer is required to meet the investment commitments, which may vary over time.

The long-term nature of the fund is illustrated by the fact that an individual fund commitment spans more than 10–15 years and an individual co-investment 3–8 years. An important aspect of the strategy is the combination of high-quality fund commitments and co-investments, with sustainability fully integrated throughout the investment process and owner phase.

For more information:

Ulf Lindqvist, Head of Communications at AP6: +46 708 74 10 48 ulf.lindqvist@ap6.se

Sixth Swedish National Pension Fund (AP6)

Long-term and active investor tasked with investing in unlisted assets (private equity). An important aspect of the strategy is the combination of high-quality fund commitments and co-investments, with sustainability fully integrated throughout the investment process and owner phase. Since its inception AP6 ha contributed SEK 58 billion to the Swedish public’s pension assets.

Since 1996 AP6’s fund assets have grown from SEK 10.4 billion to SEK 68.6 billion at the end of 2022.